Today the world’s first Bitcoin ATM was placed in Vancouver and of course I had to be among the first to try it out. So this morning I stopped by at the Waves Coffee shop on the corner of Howe and Smithe St. to take a look. There was a TV truck parked on the sidewalk and inside quite a crowd had formed. I was lucky to find a parking spot on the street right in front of Waves, so no need to find a parking garage.

I went in and saw a mixed crowd of people in their 20s and 30s, plus a lot of media (photographers, TV, traditional journalists and of course bloggers). The line for the ATM was surprisingly short, however. It seemed that most people just came to check it out and may not have Bitcoin wallets yet. After 10 minutes it was my turn and while media were filming and taking pictures I had to scan my hand palm to get started. That took some time, but eventually it worked. But then I got the message that I had to be approved first. I did not want to wait for that and went to the office. After about 30 minutes I received the message that I was approved and could buy and sell Bitcoin.

After a lunch meeting I stopped by the ATM again, this time there were just 2 people ahead of me. Strange enough the hand palm scan was not required anymore (I assume most people did not want to wait before doing a first transaction and they stopped the requirement temporarily) and I could deposit money right away. I decided to start with only 20 dollars, just in case something went wrong. It was fairly simple, you push the ‘buy Bitcoin’ button on the touch screen, scan your wallet’s QR code (or put it in manually) and put your money in. You then get a receipt and the money should be in your account in an hour (the money arrived in my wallet exactly 57 minutes after I put it in).

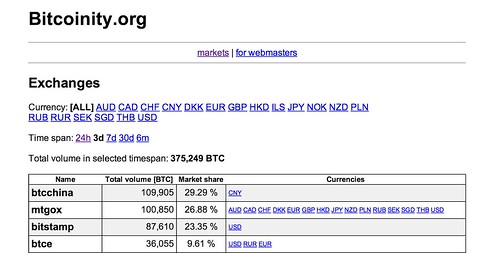

The rate that I got was about 1.5% above the actual rate on Mt. Gox ($216 vs. $213), which is okay for me. I did not withdraw any money yet, but I assume there will be a similar ‘transaction fee’. It’s a great service to have such an ATM in downtown Vancouver, and I would be willing to pay even more than this. When more ATMs arrive I assume there will be downward pressure on the fees that are charged.

For me using the Bitcoin ATM was an eye opener: for the very first time I saw Bitcoin as real money, not just money that you can transfer online to pay for things, but money that you can get out of a machine as real bills. So far it has always been virtual for me. Of course I could have sold some of my Bitcoin holdings over the past months and gotten money on a bank account, but now I see actual real money coming out of an ATM.

This is a significant event for the acceptance of Bitcoin, because most people use ATMs already anyway. This is a similar experience to a normal ATM, except that you don’t use a bank card but a QR code of your wallet. Everybody who has a wallet can now buy and sell Bitcoin with real cash! I realized that this ATM is what was missing to make Bitcoin more mainstream. The other thing that’s still missing is a safe and easy-to-use wallet, but I know that several companies are working on this challenge.

If I would be selling these Bitcoin ATMs I would ship them to India or other countries where people receive money through Western Union or through shadow banks. These money transfer services charge 10% or more on transactions and it can take quite some time to receive the money. With Bitcoin ATMs that can be done for a fraction of the cost and in a fraction of the time. There are huge business opportunities that could completely disrupt the banking industry.