The falling Bitcoin price gives many people the impression that Bitcoin is dying, but actually the opposite is true. Yes, the price has been on a downward spiral for a long time and right now there is massive panic selling going, but for me that does not mean that the currency or the blockchain have failed. After record VC investments last year I expect a lot of companies to release Bitcoin related products over the next couple of months, and I think that once the price reaches a bottom a lot more people will start using it, either directly or indirectly. I am now sitting on an airplane, so I finally have some quiet time to put my thoughts in a post.

Let’s start with the elephant in the room, what is happening with the price? I am regularly asked by people what is going on, some are just curious, others are annoyed that their investment is not doing well and some are panicking because they put too many savings into Bitcoin. To be honest, nobody really knows for sure what determines Bitcoin prices on a daily basis, but I have some thoughts on this. I am a member of several private Bitcoin message roups on WeChat and on Telegram and the price is a regular topic of debate there (but certainly not the only topic).

Everybody has different opinions, but the consensus seems to be that the huge volatility and price drop we are seeing right now was not expected among the people who spend most of their time in the Bitcoin world, but that it’s also not unusual for such a young and hyped currency, and that Bitcoin has seen this kind of drops before.

Most people were not part of Bitcoin yet in 2011, but in early June that year the price reached $32 only to fall to $10 a few days later. The bottom of the following bear market was at $2 in November 2011! So if history repeats itself the price could fall a lot more than it has done so far, and maybe that would be a good thing.

I still spend a lot of time on Bitcoin and am surprised that Bitcoin would fall so much. The main reason that the price has been on a downward trajectory is actually partly because of its success: more companies accept Bitcoin (among others Microsoft, Paypal and Dell now take the crypto currency) so more people are using Bitcoin that they already own to pay for goods. The problem is that merchants change these bitcoin for fiat currency right away, leading to an increased supply of coins. Only when they would hold on to them (e.g. when they could use BTC to pay their suppliers or pay their staff, or if they would believe that the value would go up) the markets will stabilize, and that is just not happening yet. And in a downward market there is less incentive to buy new Bitcoin for people who spend it, because people expect the price to be lower in the near future.

To make matters worse, the Bitcoin miners that used to hold on to most of their Bitcoin are now spending them to pay for electricity. The lower the Bitcoin price the more coins they need to sell to pay for their costs. At current prices it’s almost impossible to make money with mining and some companies even stopped their mining operations (see for example http://www.coindesk.com/cex-io-halts-cloud-mining-service-due-low-bitcoin-price/)

What we are seeing now is that people who bought coins in the uptrend are panicking. Many of these must have bought coins when prices were far higher than today and they may now worry that the value of Bitcoin may eventually go to zero, and so they cut their losses and sell. Smart? If you need the money it may be a wise decision, but if you bought the coins with money that you were prepared to lose I would hold on to it.

This is typical behavior of small investors and it normally indicates that the bottom is near. Soon bulls will come back into the market and start buying coins on the cheap. The question is of course when this will happen, and that is something nobody knows. I personally have not sold a Bitcoin over the past months and I am not planning to do so now either (many people are like me it seems, 70% of all Bitcoin have not moved in the past 6 months). But I am also not buying yet, mainly because I feel I have enough exposure to Bitcoin in my portfolio. If I would not have Bitcoin yet, however, I would probably put some orders in soon. Don’t take this as investment advice of course, and keep in mind that most people are a lot more risk averse than I am.

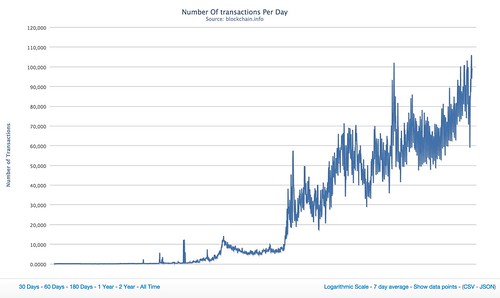

Actually, Bitcoin usage was at an all-time high a few days ago, with several days of over 100,000 Bitcoin transactions per day. Still tiny compared to other financial transactions, but there is a clear uptrend despite prices going down. And take into account that so far there are hardly any good use cases for Bitcoin for the average consumer.

I am probably one of the bigger Bitcoin users in the world right now (in terms of number of transactions), because I have a Bitcoin debit card. This card was issued by Blade Financial, a company that CrossPacific Capital invested in and where I am on the advisory board. I use the Bitcoin debit card on an almost daily basis. All over Vancouver I pay in Bitcoin, but none of the merchants know that of course, and they don’t have to know it either (they only see dollars, not BTC). It works great and I believe that once this card launches officially (this is just a test card) a lot more people may be exposed for the first time to Bitcoin.

VC investments in Bitcoin companies are still on the rise and I hear about new Bitcoin companies on an almost daily basis. Bitcoin is far from over and maybe the shake-out that will be caused by the low price is a good thing. Of course the low price will lead a lot of people to be even more skeptical about Bitcoin, but that can change quickly if the price stabilizes and will start increasing again.

Like I said earlier, nobody really knows what determines Bitcoin prices. I am just pointing to some trends that I observe in the market and that play a role in Bitcoin prices. One thing I did not mention yet in this post, but that I talked about in the past, is that institutional money can still not invest in Bitcoin because there are no ETFs on the market. I had expected that the first ETF would have been launched much earlier already, but the SEC is taking its time to approve these funds. The first one will likely be the Winklevoss fund and that could well lead to an unexpected rally when suddenly demand goes up much higher than supply.

I find the Bitcoin world fascinating and I am still very happy to be part of it. The low price leads to completely new dynamics in the market and because of that I keep on learning new things (sometimes the hard way!). Changes go much more slowly than I had expected, but I see that changes are taking place, both with blockchain applications and with Bitcoin as a currency. I look forward to the next year in Bitcoinland and being part of it as a participants, an investor and as an evangelist. The best is yet to come!

I’ve added some extra price alerts in the Bitcoin Ticker app. I want some more bitcoins.

Great digest of the current situation. Its good to know that more and more people who have skin in the game are taking the long term view.

English language? Please add me to a wechat group @ cdhsllc

great post marc. Sounds like a good time to buy into the future. Can’t wait to see the blade card in action.

Hi, i would like to know if is possible to offer you $50 so you can add a link to a bitcoin site at the following article:

https://www.marc.cn/2015/01/bitcoin-quo-vadis.html

I can send sample of the text link that will be added to the article.

Thanks!

I don’t do any paid articles, sponsoring or advertising on my blog, so not interested.